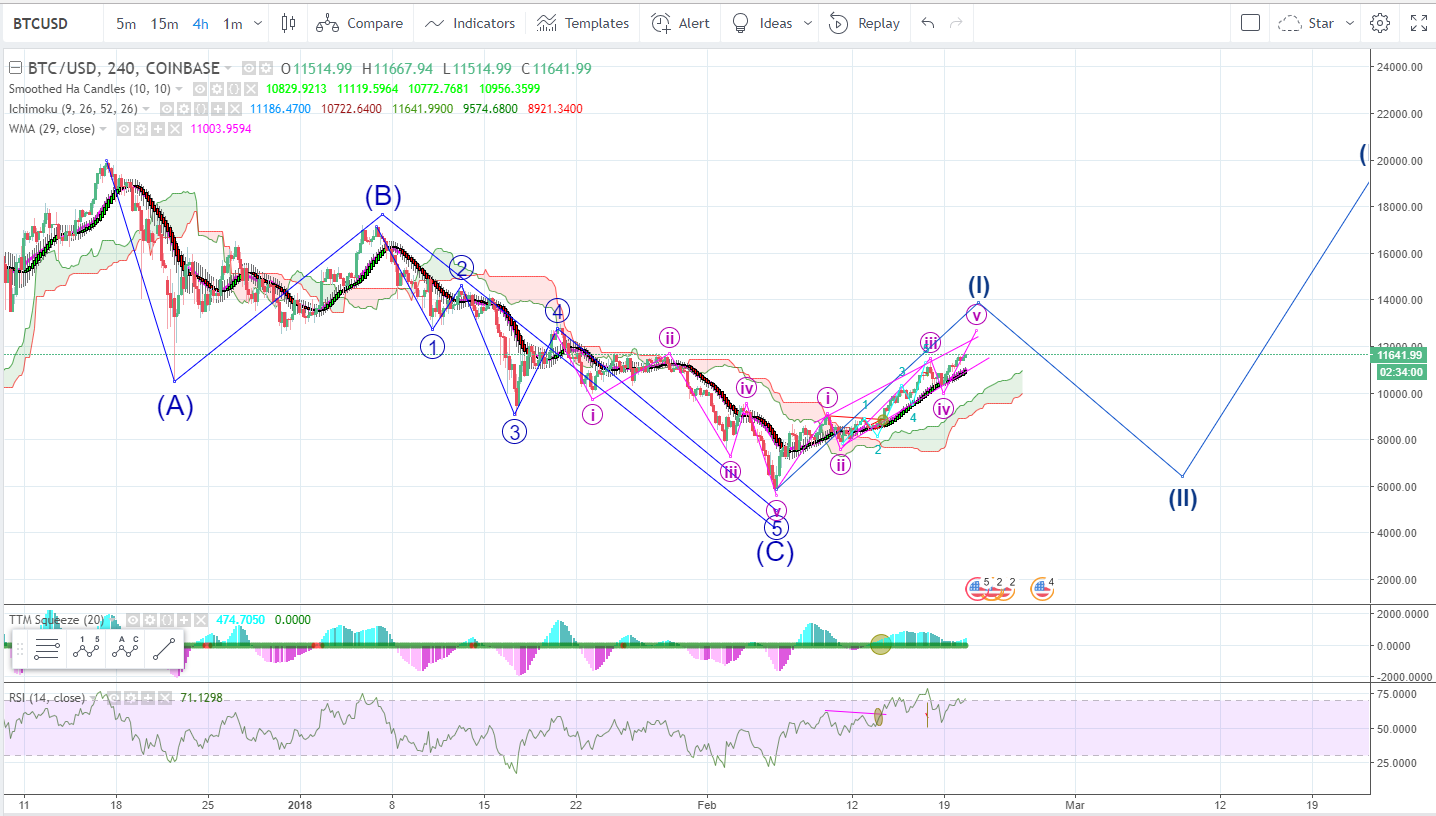

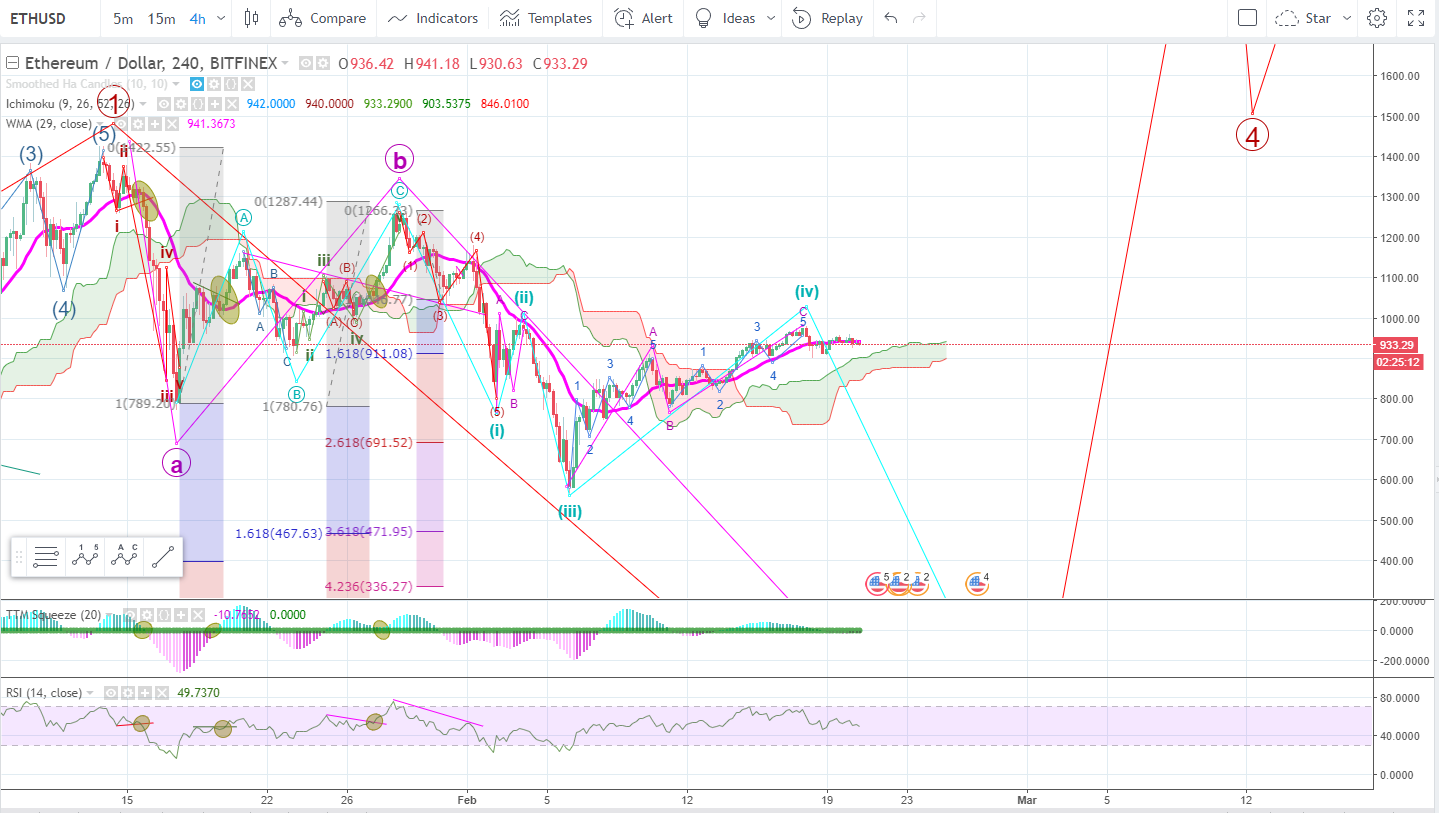

Bitcoin is on a no quit tear, with it continuing to chop around in the mid-$11k area we will presume to look at the Bullish count as the primary count and hold the Bearish count as a secondary since we expect either a C wave decline or a Wave 2 decline. The main source of contention seems to be that Ethereum and Ripple are not confirming BTC's move higher. If Bitcoin has been on such a tear, why are the other main currencies not making new highs also? This has to be a red flag that something is not right, especially since most of the time ETH will often outpace BTC's rise. These are things to keep an eye on but we are seeing a steady rise in Crypto Market Cap.

News:

Bank of England Claims Bitcoin Has 'Failed' As A Currency:

https://cointelegraph.com/news/bank-of-england-governor-claims-bitcoin-has-failed-as-a-currency

Top South Korean Crypto Regulator Found Dead:

https://www.zerohedge.com/news/2018-02-20/south-korean-crypto-regulator-found-dead-his-home

This Bullish Bitcoin chart will now be our primary count to work from since the C wave we had in the Bearish chart for a 4th wave is nearing invalidation territory. Both these charts predict a decline so they would agree in that sense. The main contention that we've had with this count is the pink sub-wave iii and iv of the Blue 5th wave decline are much smaller than pink i & ii. This is still a valid count it is just really rare and was not the most probable scenario until now.

*Note*-There was a bullish buy trigger for Feb. 14 - We were reluctant to call it if it was going to be a suspected short C wave but it did turn into a runner.

Ethereum, as noted above, is failing to confirm the rally in Bitcoin. This is typically not how ETH trades when Bitcoin goes into buy mode. Usually ETH is posting a few % gains higher than BTC. This is somewhat of a red flag and we will continue to post the Bearish chart until we get some clear indication that we might be on our way to a Bullish uptrend.