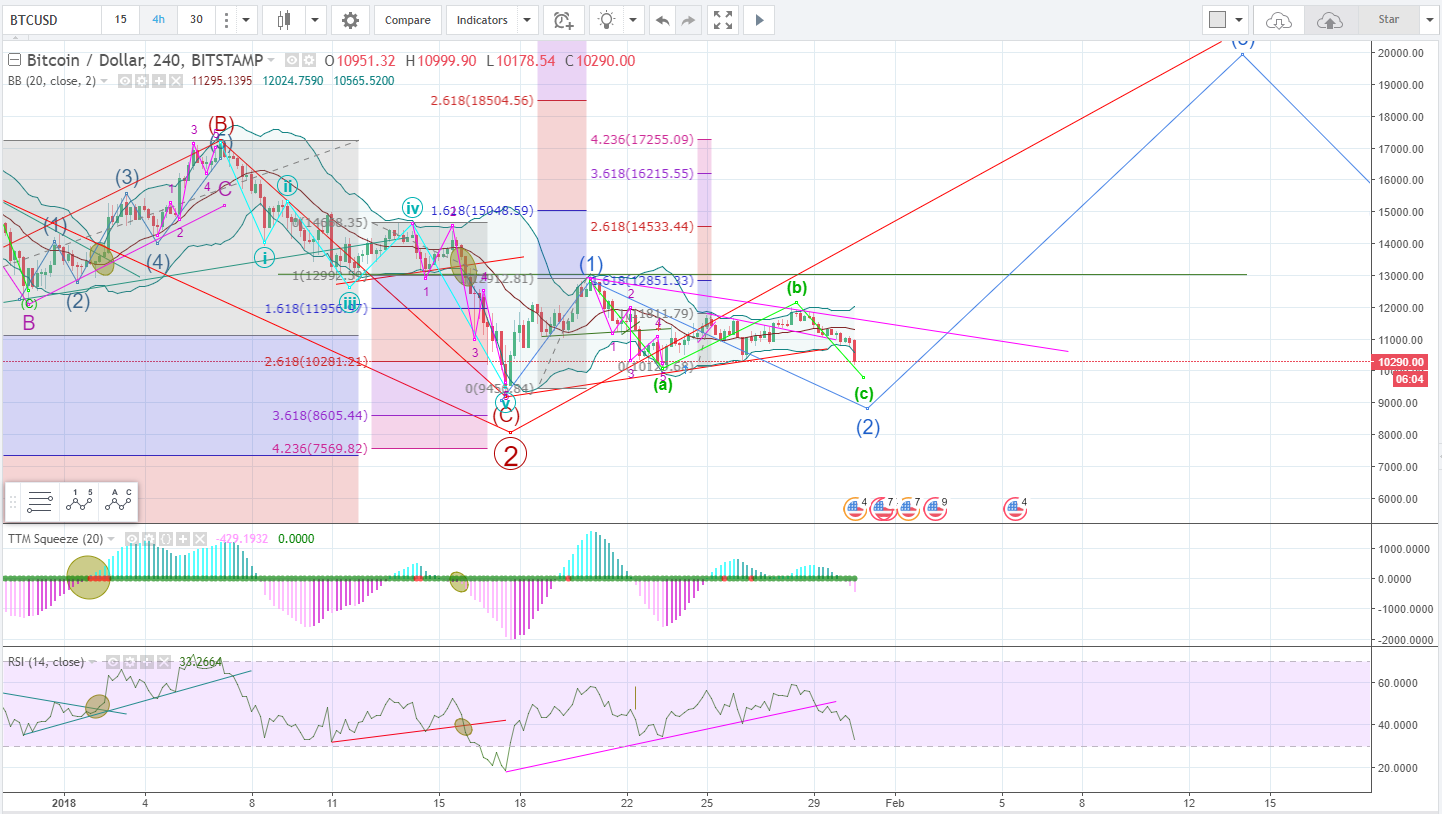

Overnight saw increased selling pressure. Most of the selling has come early this morning and would be an indication of more investors possibly increasing their shorts against Bitcoin. As previously noted, the BTC market is heavily weighed down with shorts and with South Koreas implementation of banning Anonymous Trading. We still hold a bullish outlook at the moment, but until there is clear movement in either direction, it will be hard to determine the correct wave count. The markets are like trying to fit puzzle pieces together but given only one piece at a time, which is why it is best to wait until the picture is clearer and more pieces are in place before presuming to know where all the pieces fit.

News:

Bitcoin Slides As South Korean Trading Ban Goes Into Effect - Forcing Would Be Tax Avoiders To Dump And Dash:

For this Bitcoin chart, we expanded the blue Wave 2 and it will be invalidated below the previous low of $9200 area. A break above that upper pink trendline on the price chart would signal the beginning of a MONSTER short squeeze and a rally higher.

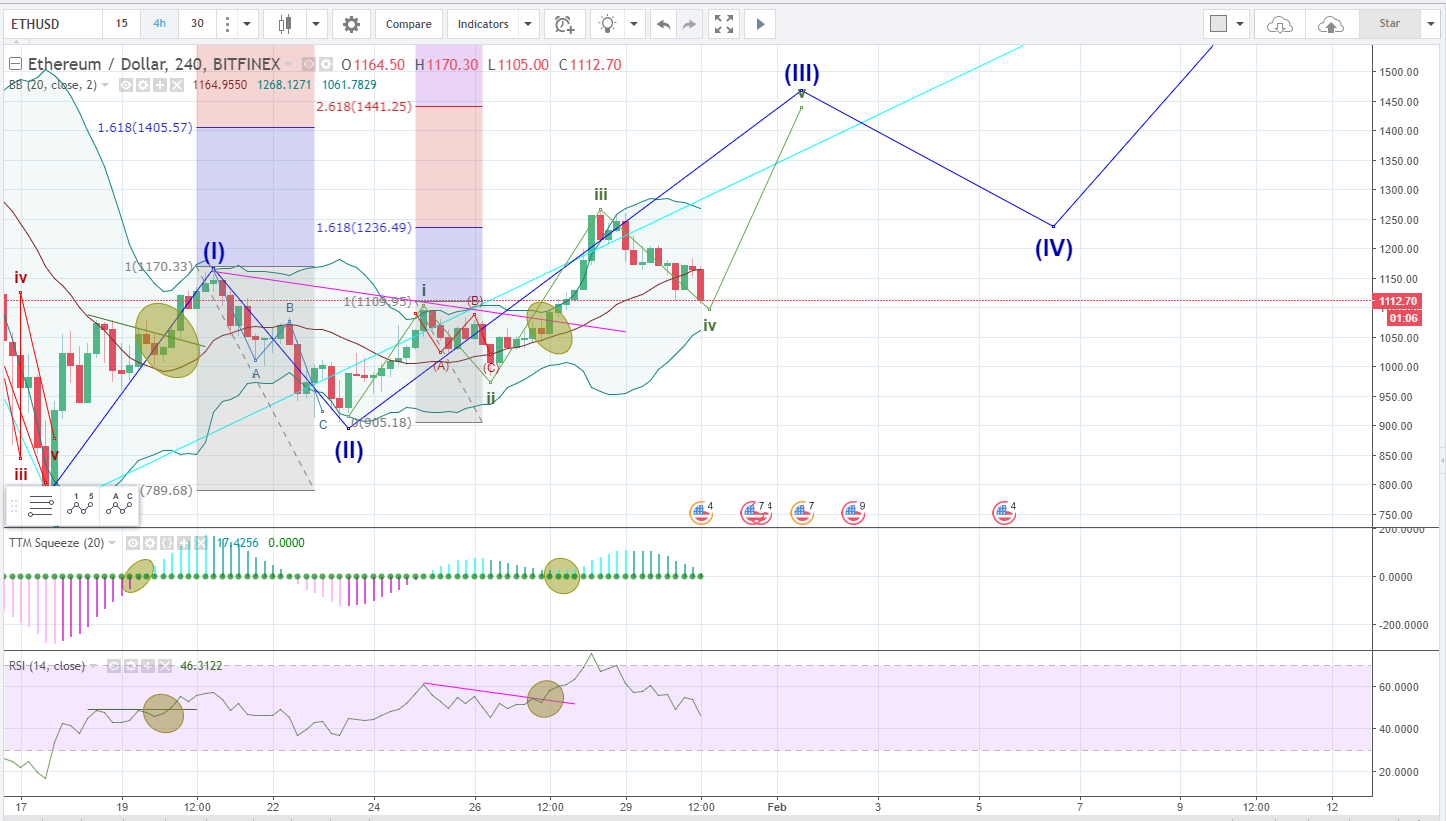

Ethereum prices must hold the current level of 1112 or higher otherwise it will invalidate this current count. If BTC does enter a short squeeze then this V Wave could be explosive and beyond the 2.618 Fibonacci Extension. However, if it fails to hold, then look out below because BTC and ETH will be liquidated with the rest of the Crypto Market. For the purpose of the ETH 'Buy Trigger', selling out here would essentially be a scratch trade if no profits were taken at the first 1.618 Fibonacci Extension level.