Overnight we did see some buy triggers in Bitcoin and Ethereum. These could be taken as a quick scalp but the setups are less than ideal. We could be wrong and miss a good entry but we remain optimistic that another better bullish setup will appear in the coming weeks to last us for a month or more of explosive gains. There is a ton of overhead resistance that could allow the main cryptos to play out to the downside.

News:

Crypto Comeback:

South Korean Banks Profit From Cryptos:

https://cointelegraph.com/news/s-korea-major-banks-income-from-crypto-accounts-up-x36-from-2016

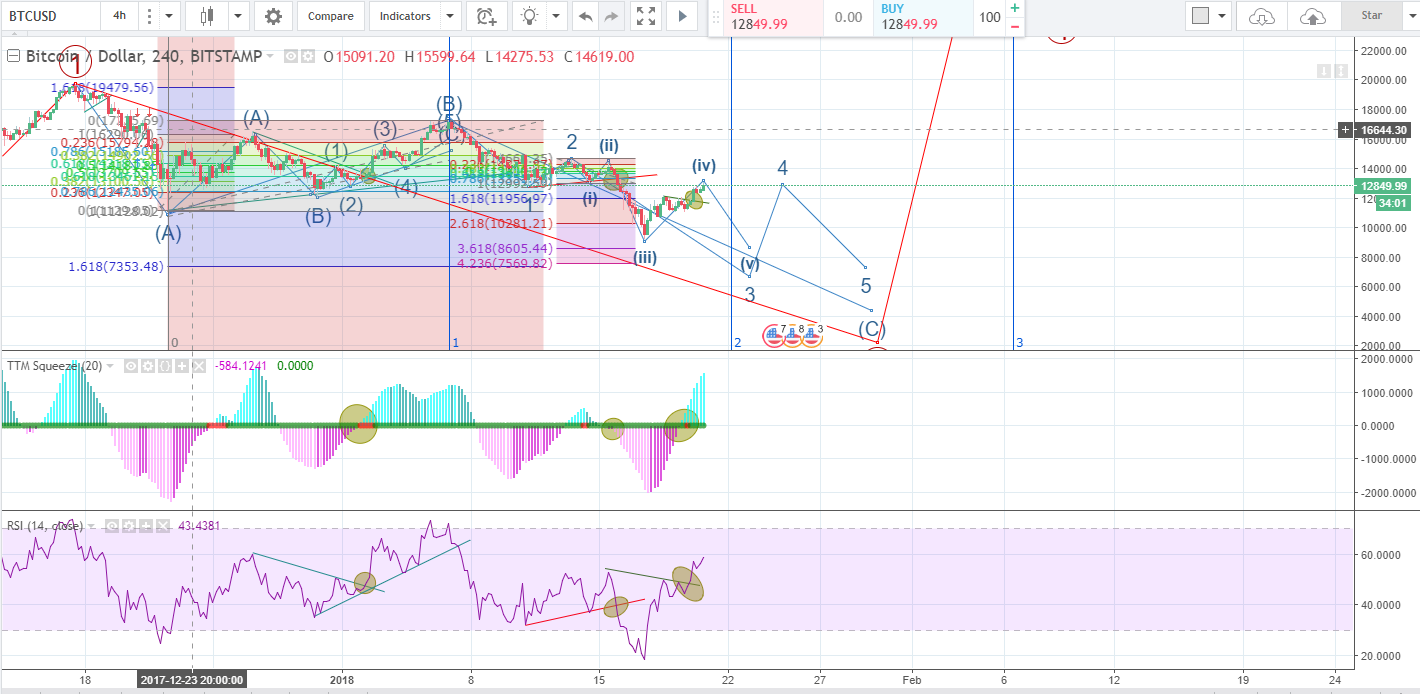

Bitcoin is hitting significant resistance here despite the panic buying pressure. Wave iv should not go past $14500 or it will invalidate the current wave count. Ideally wave iv and wave i should not overlap but in this case as part of a greater C wave decline, there is often overlap. If the trigger was part of a small ABC correction in wave iv then the 'Buy Trigger' here would only be a short scalp before seeing further declines.

For Ethereum we see a continued rise and therefore no ABC correction forming for Wave II yet. This also would be seen as a short scalp 'Buy Trigger'. At $1150 Ethereum should hit significant price resistance and hopefully see a decline towards Wave II.

Ripple here is the odd one out. This is really interesting because if all the other Cryptos are catching a bid and this is a break out rally, why isn't XRP moving higher?